New business models for a different retail future

In May 2020, shopping centre rent collection among US REITs fell below 50%. In the UK, retail was hit even harder: just 13.8% of retail rent was collected in the quarter to June, falling to 12.7% by Q3 2020.

Although those numbers have since improved dramatically, uncertainty caused by the pandemic is reverberating through the sector. Brands want more flexibility while footfall continues to be volatile and unpredictable. As a result, landlords have started to look for innovative ways to keep income rolling in. Many of these will likely outlast the pandemic itself.

Revenue splitting

Uncommon in the UK before the pandemic, turnover rents have become part of the discussion in recent years, according to Savills. Specifics will vary from one lease to another, but in general these agreements give landlords a certain percentage of a brand’s turnover (typically between 1 and 15%), allowing the tenant to better withstand fluctuating sales.

But revenue splitting is not simply about helping tenants weather the storm of uncertainty. With the acceleration of online shopping, brands are increasingly pivoting towards omnichannel retailing, with both physical and digital stores – and landlords are getting involved.

As landlords ramp up efforts to support tenants’ online activity – for example, by also offering logistics space – they will expect to share some of the windfall from internet sales. Panellists at the roundtable argued that landlords will expect to share some of the windfall of internet sales, particularly as they ramp up efforts to support tenants’ online activity – for example, by also offering logistics space.

The panellists also argued that even in markets where online shopping hasn’t yet taken off as it has in the UK, such as the Australian market, shopping centres should incorporate logistics space to serve occupiers’ needs as they grow. By sharing online revenue, both landlords and tenants can benefit.

Flexibility

Brands want short-term but extendable leases – ones measured in days or weeks, rather than months. According to retail leasing platform Appear Here, that has been a feature of previous downturns, but flexibility is expected to stay. Conversion times have been accelerating for several years, and in 2020 nearly half of bookings were completed within three days of a request, according to the company.

Occupier needs are shifting the market towards more flexibility. Brands do not want to commit to long-term leases, but they do still want their physical space. As with revenue sharing, there is also an upside for landlords: according to the same research by Appear Here, flexible spaces can generate as much as 43% more revenue than traditional rent.

Shanghai has seen this trend play out successfully at TX Mall, where pop-ups are the foundation of the space’s strategy. The mall gives popular online brands a physical environment with a three-month rent-free period in return for a percentage of sales. Last year, it attracted 5,000,000 visitors.

Multi-use space

At the roundtable discussion, one panellist said that if landlords are going to succeed, they have to be open to working with tenants who are creative in how they use space. They said they are looking at retailers that do several different things depending on the time of day.

That means the space can potentially be used for more hours of the day than it otherwise would – for example, by switching from a co-working space during the day to a bar in the evening.

Mixed-use in the more traditional sense can also be a hedge for landlords. Retail in mixed-use developments commands a rent premium, but even in places where that premium is low, retail can play a role in making the entire development more attractive. People want to live in places close to where they work, shop and socialise. Offering the right mix of retail can, therefore, boost rent in safer, more predictable parts of a development, such as its residential space.

Investing in retail tech

Regardless of how retail will change in coming years, businesses in the sector will have to be able to keep up and adapt. For Marks & Spencer, that meant teaming up with start-up accelerator Founders Factory in 2018 in a joint venture to identify and support innovative businesses.

In the first year of the joint venture, the partners invested in start-ups that did everything from offering customers portable power banks, to creating a marketplace where farmers could sell surplus produce.

As the retailer’s chief digital and data officer, Jeremy Pee, said at the time, Marks & Spencer’s involvement would enable it to “work with and learn from disrupters and not be disrupted". The message is clear: in a time of changes, adaptation is necessary for retail success.

Our thanks to:

Albert Chu

Claire Hepher-Davies, The Crown Estate

David Waldren, Vicinity

Joanna Russell, Frasers

James Hepburn, Ipswich Council, Queensland, Australia

Lucy Puddle, Grosvenor

Paul Husband & Vicky Li, Husband Retail

Stuart Harris, Milligan

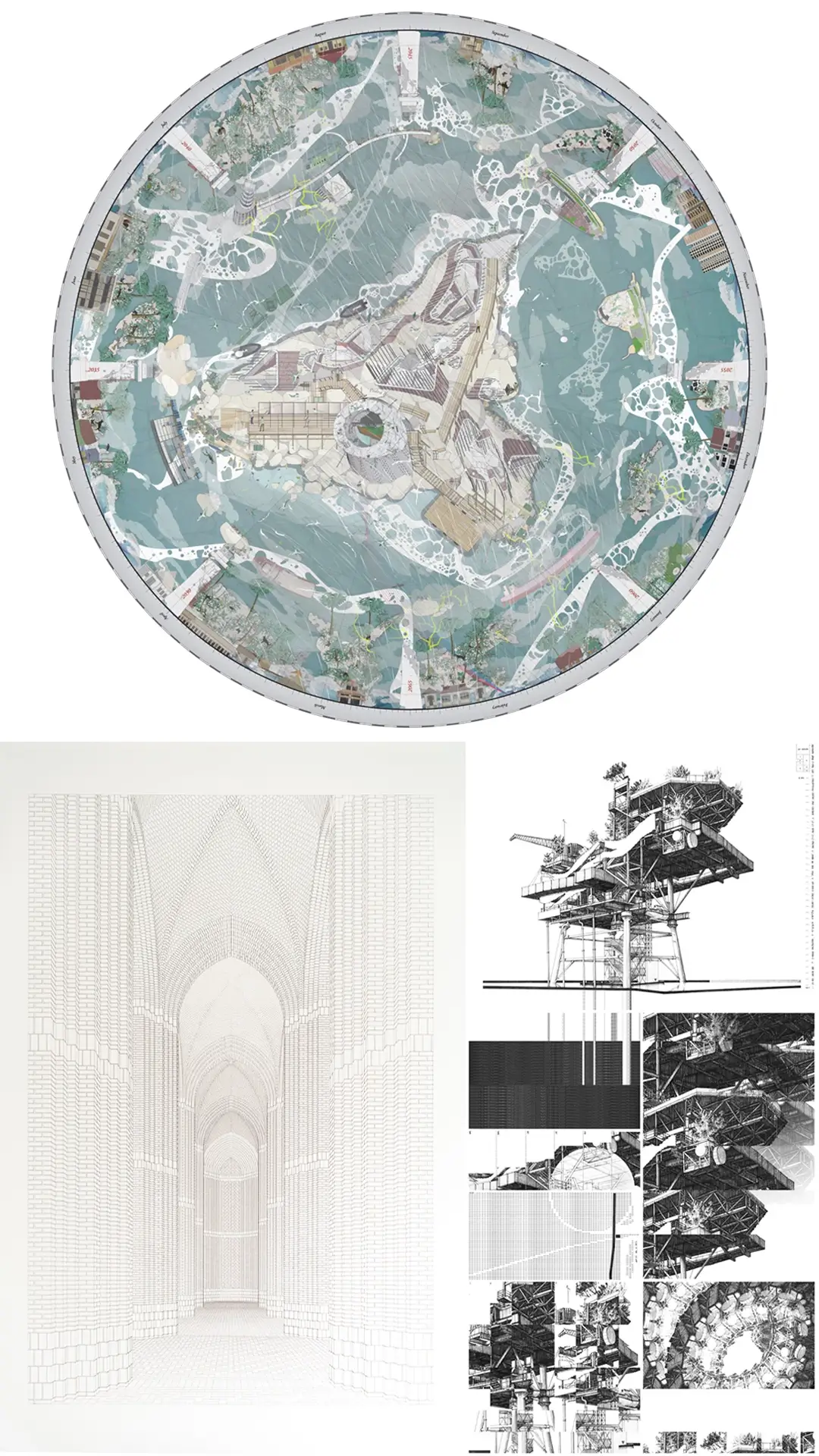

Make Retail portfolio