Fair Tax Mark Statement for Make Architects

This statement of Fair Tax compliance was compiled in partnership with the Fair Tax Foundation (“FTF”) and certifies that Make Limited and its subsidiaries (‘we’, ‘our’, or ‘us’) meet the standards and requirements of the FTF’s Global Multinational Business Standard for the Fair Tax Mark certification for the year ended 31 December 2021.

Tax policy

Our tax policy is to always operate within both the letter and spirit of all the tax laws that apply to our operations. Therefore, we don’t use artificial tax avoidance schemes or tax havens to reduce our tax liabilities.

We’re committed to paying all the taxes that we owe in accordance with the spirit of all tax laws that apply to our operations. We believe that paying our taxes in this way is the clearest indication we can give of being responsible participants in society. We will fulfil our commitment to paying the appropriate taxes that we owe by seeking to pay the right amount of tax, in the right place and at the right time. We aim to do this by ensuring that we report our tax affairs in ways that reflect the true economic reality of the transactions that we undertake during the course of our trade.

We will never seek to use those options made available in tax law (or the allowances and reliefs that it provides) in ways that are contrary to the spirit of the law. Nor will we undertake specific transactions with the aim of securing tax advantages that would otherwise not be available to us based on the reality of the trade that we undertake. We don’t use artificial structuring to gain an artificial tax benefit. We only use business structures that are driven by commercial considerations, aligned with business activity and which have genuine substance.

All intercompany transactions are at arm’s length and in line with industry norms; we would never abuse the use of so-called ‘secrecy jurisdictions’ or tax havens to avoid taxes. Each jurisdiction that we have a presence in is underpinned by legitimate commercial activity.

Our financial statements and tax filings will be prepared in compliance with this tax policy, and we will always be open, honest and transparent with tax authorities.

Our board of directors shall be responsible for overseeing the application of this policy and can confirm that it has been complied with for the year ended 31 December 2021.

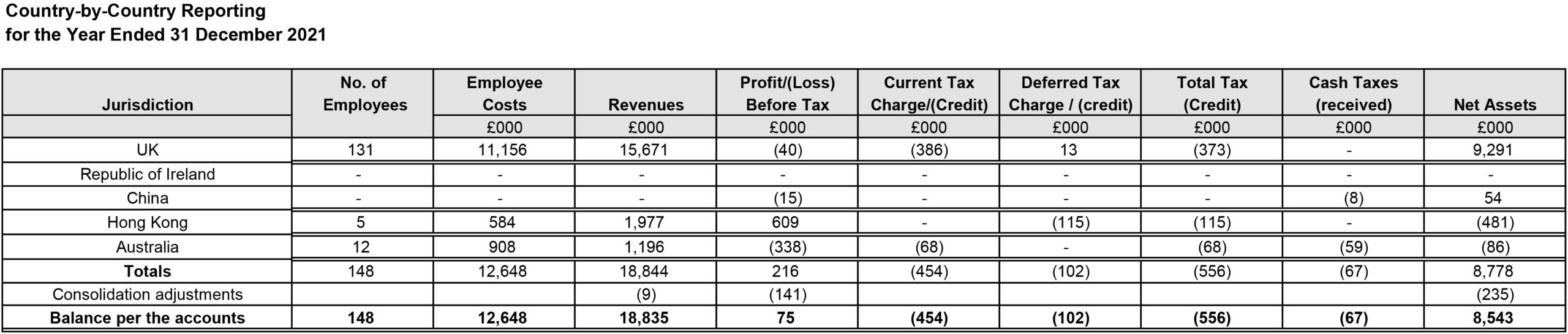

Public country-by-country reporting

The country-by-country disclosure below shows our economic footprint across all jurisdictions that we operated in for the year ended 31 December 2021.

Additional narrative disclosures

Our subsidiary company in the Republic of Ireland was dormant throughout the year ended 31 December 2021, which is why there are no figures in the above table for this particular jurisdiction. This dormant company was then liquidated in June 2022.

Our presence in Australia is via a branch of UK-based Make Limited.

The country-by-country table above shows that we’ve made losses before tax in each jurisdiction that we were active in, except for Hong Kong. There was no tax charge in Hong Kong, mainly due to previous years’ losses being offset against this profit.

The main reason for our current tax credit position in 2021 was due to claiming Research & Development (R&D) relief on qualifying spend. R&D tax reliefs support companies that work on innovative projects in science and technology. It can be claimed by a range of companies that seek to research or develop an advancement in their field. Some of our R&D activities related to improving spatial energy efficiency, enhancing fire resistance, and net-zero carbon structural systems.

For the year ended 31 December 2021, we were classed as an SME (Small and Medium-sized Enterprise) for R&D tax relief. This meant we could claim additional tax relief on our qualify expenditure and, if this resulted in a loss, claim a payable tax credit.

With regards to our deferred taxes as of 31 December 2021, these all relate to accelerated capital allowances. Accelerated capital allowances are a timing difference between how fixed assets are treated in our accounts and how they are treated for tax purposes. In the accounts, fixed assets are depreciated over their useful economic lives, and this is usually different from the fixed rules in tax laws on how to claim for fixed asset expenditure. This is a timing difference that will unwind over the useful economic lives of the assets.

For the year ended 31 December 2021, we had no transactions with any related parties that didn’t form part of the consolidated group.